17 May 2021

The COVID pandemic has impacted all of us in different ways and there is no doubt that our life experiences over the last 18 months have taken a dramatically negative turn. And of course, we remain concerned about the next few months despite the brilliant vaccination rates in the US, UK and shortly we hope Continental Europe.

The massive interventions in markets from Central Banks, Governments and associated entities made a significant impact, however. Alongside the dramatic shift to working patterns, our clients in the Investment industry have had record years in terms of revenues as Markets have boomed following the brief hiatus in March/April. Allocators continued to allocate, money was “left on the table” and pandemic trends have seen rapid growth in Private Equity and (less so) Private Debt fundraising.

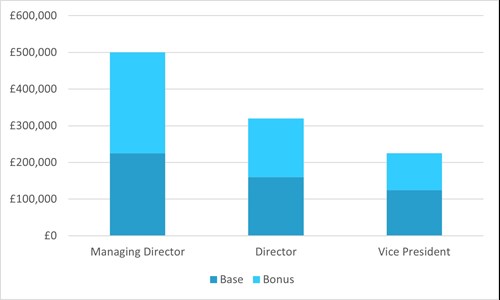

The Real Estate Investment sector has benefitted alongside these trends, in particular given the ongoing historically low level of interest rates. Our snapshot of the UK Real Estate Investment sector’s average compensation levels reflects the continued appetite for the asset class and talent within it. This has played out, largely, in statis within a total compensation basis, but given everything we have been through, this is no bad thing.

A. Investment Professionals:

2020 was an active year for Investment professionals in the sector. Despite some sector specific downturns – in the obvious sectors such as retail – there remains strong demand for origination and execution capabilities. This is even more true at the higher yielding end of the market and our hiring has focused in this context – either individuals or team moves.

Individuals at Asset Class focused funds have seen compensation flat or slightly higher. Those at larger institutions who have been impacted by other parts of the business seeing downturns, have perhaps struggled to achieve similar compensation levels. This is of particular relevance in the absence of carry schemes at these firms.

B. Asset Management:

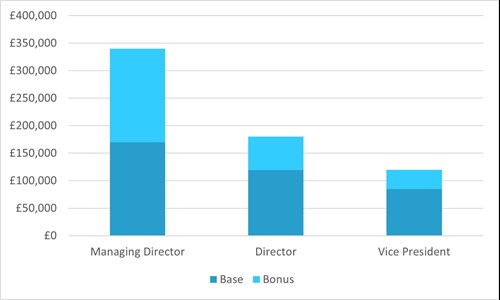

This competence has been where we have seen the most hiring activity within our client base. For obvious reasons, the skill set has come powering into demand and as such compensation levels have increased. We are seeing individuals with this background able to command greater and greater compensation levels with multiple offers for top talent to choose from. This also means clients are keen to retain such talent.

C. Fundraising:

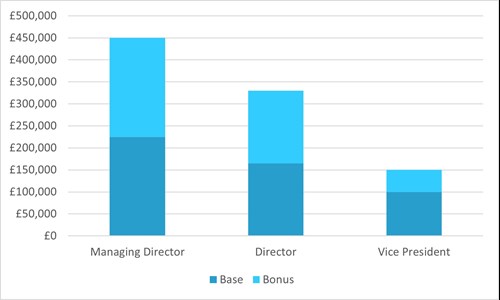

In a low interest rate environment, allocator demand for illiquid asset classes has boomed. As such, demand for Fundraising talent that has a track record of raising AuM, a rolodex of clients to engage and a structured approach to relationship management remains undimmed. In particular, country or region specific hiring has been a specific focus for AMC. In addition, the growth of demand for Real Assets from Pension Funds through to HNW and top end Wholesale means channel specific fundraising talent grows and grows.

SUMMARY

The oldest asset class in the world remains in high demand. Whilst 2020 was a challenging year for all of us as well as specific Real Estate sectors, the overall picture for talent and compensation remains strong and we are confident that will remain the case in 2021 and beyond.