1 February 2023

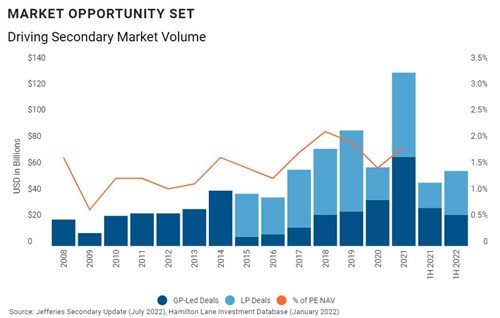

Direct investments continue to comprise the vast majority of transactions across private markets however, within private equity, there has been a significant shift towards the secondaries market. Historically, the secondaries market has attracted LPs for liquidity purposes, allowing investors to exit an investment sooner than the fund lifecycle would normally allow.

In turn this requires LPs to sell their interest to a secondary buyer. Liquidation of such assets allows for portfolio adjustment, and ability to invest the freed-up capital into another more attractive strategy. There are equally attractive reasons for LPs to be purchasing private investments on the secondaries market as there is far greater visibility to the investment being made as they are able to see fund performance from previous years, and consequently mitigate a great deal of the risk which is taken in a newly formed fund.

Recent entrance of LPs in the secondaries market with private investment comes from a multitude of reasons. The vast economic fluctuations in recent years and the most recent rise in interest rates has meant that investors have looked away from public investments to the stability of private investments.

Since this dramatic shift, over-allocation has resulted in the attraction of the secondaries market for the reasons mentioned above.

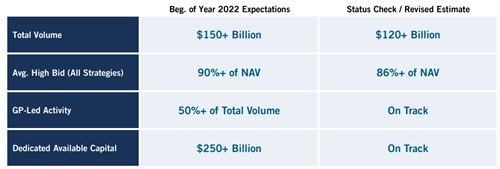

These single asset transactions have shown sustained growth, with the secondaries market having reached a transaction value of $56billion in 20221. With that being said, the increased transaction flow and increased competition in the market has led to prices being driven down and LPs having to sell their investments at a discounted price. However, this seems to be a worthy trade-off for LPs.

2

2

As leading global asset managers seek to diversify their investment toolkits, private markets continue to be top of the agenda, with M&A activity remaining high in the space. Notably, Franklin Templeton acquired Lexington Partners as their private equity secondaries and co-investment function in April 2022. Competitors have entered into similar expansions, such as CVC’s strategic partnership with Glendower Capital, a private equity secondaries specialist.

As the market continues to grow and sophisticate, teams are adding talent at all levels, with significant moves in the space including Pantheon Venture’s hire of Amyn Hassanally as Partner & Global Head of Private Equity Secondaries (based in NYC), and Bellevue Asset Management’s launch of their private equity secondaries fund hiring Chris Davies, Steven Kroese, and Lars Honegger from Partners Group.

Seasoned direct private equity professionals are increasingly making the move to secondaries funds, with fluidity and competition steadily increasing. Previously, candidates with an investment banking background were the preferred pool of talent. However, more recently, there has been more circulation between private equity firms which has created a war for talent in the space.

The portion of the secondaries market which has grown exponentially is across GP led transactions. Activity has rapidly increased with GPs entering the market to transfer and manage pre-existing funds in a continuation vehicle. This transaction requires GPs to notify and offer optionality for LPs to either maintain investment in the fund under modified terms and a new vehicle, or, to sell their stake under the current fund terms. Motivation for GPs to transfer a fund to a continuation vehicle is incentivised by the prolonging the lifecycle of a fund which is nearing completion to facilitate greater returns.

3

3

Sameer Shamsi, Head of Secondaries at Houlihan Lokey has stated “while the stage is certainly set for more GP-led transactions to come to market in 2023, these transactions will compete with one another, as well as an increased supply of LP portfolio transactions, for secondary investor attention. In this competitive environment, the bar for successful GP-led secondary transaction processes will remain very high, with secondary investors prioritizing transactions involving the highest quality assets managed by the most reputable GPs where the transaction terms create strong alignment.”4 Increasing sophistication across the secondaries market has been evident throughout this shift as sector specific LPs and GPs home in on the opportunity that the market provides.

[1] https://www.institutionalinvestor.com/article/b8x4gj2f5tf89y/Investors-Are-Using-the-Secondary-Market-to-Fix-Their-PEPortfolios

[2] https://www.jefferies.com/CMSFiles/Jefferies.com/Files/IBBlast/1H2022-Jefferies-Global-Secondary-Market-Review.pdf

[3] https://www.hamiltonlane.com/en-us/insight/what-is-driving-the-secondary-market

[4] https://www.fnlondon.com/articles/secondary-heavyweights-on-what-2023-holds-for-private-equity-20230104