27 March 2023

The Opportunity

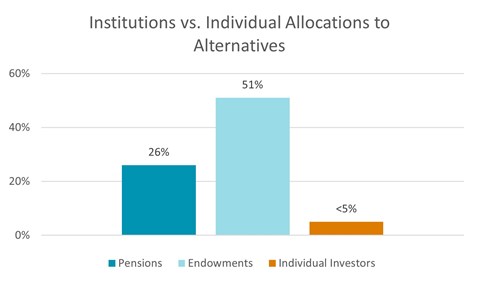

The economic landscape is ever changing, and this has certainly been the case for both Private Markets and for the investors who look to enter this asset class. Private Markets have shown significant levels of stability over recent, turbulent years and have become increasingly attractive to investors. Traditional closed-ended funds have historically had high barriers to entry and have only been accessible to institutional investors.

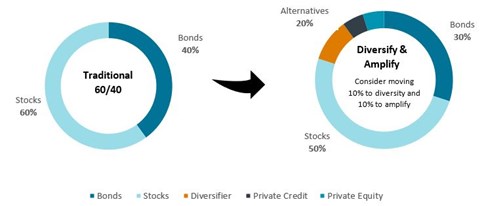

Firms who manage wealth be that Family Office, Private Wealth or Mass Affluent money, see Private Markets investment strategies as being a source of future growth. Greater public market volatility, inflation outlooks, fluctuating public fixed income and the consistent rate of returns in Private Markets are all considerations.

In turn, this has presented a new opportunity for alternative investment management firms as a new pool of capital has become apparent. Having allocated a great deal to private markets, institutional investors now seek to re-balance their portfolios. This has led to private markets investment firms looking to raise capital from other sources. Therefore, with the interest coming from wealth clients, a new era of distribution has come to fruition.

The U.S. has led the way, with many private equity and alternative investment firm’s having built out specialised private wealth distribution teams. Firms include Blackstone, Apollo, Omers, and others. It has become clear that there is extensive opportunity to expand this offering to wealth clients across Europe and other jurisdictions.

“Once a relatively nascent segment of PE, private wealth now commands attention in its own right. According to Capgemini’s World Wealth Report 2022, the global high-net-worth individual population grew by 7.8 percent in 2021, while global wealth totals grew by 8 percent. By Capgemini’s calculations, this takes global wealth up to approximately $85trillion. To ignore such a vast – and growing – opportunity would certainly be foolhardy.”1 The link between these investors and access to private markets involves the ever expanding relationships between wealth managers, private investment firms, and the fintech platforms which facilitate investors access to this market. Platforms such as iCapital, Moonfare and S64 are pioneering this space.

(The above chart is for illustrative purposes only. Source: BlackRock)

Issues to consider when building a Wealth Solutions offering in Private Markets

Define the Opportunity

Private Markets investors see Global Wealth as a channel of opportunity. This is both because Institutional investors may feel over exposed to longer dated investment strategies with the public markets turning down. Equally, the pools of capital available in Wealth channels are exciting to capture for large Private Markets firms. Do you believe this shift is a long term play? Will the higher regulatory costs associated with building more investor friendly liquidity profiles in product be worth it? Or will institutional investor sentiment shift back to these investment strategies as markets settle, negating the need to build into the channel.

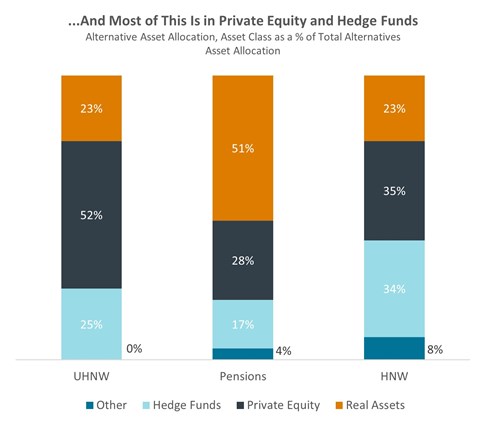

Align Product to Client Demand

Private Markets carries a broad range of investment strategies within it. Private Equity, Private Debt, Real Estate, Infrastructure – all carry different return profiles but are all relevant to asset allocation discussions with large Private Wealth Managers. Entering the Wealth Channel, investment firms need to be clear what their proposition is, why it will stand out from the crowd and not simply seek to be a “me too” approach to asset raising. Some investment firms have created new sub brands in their organisations often with the moniker “Wealth Solutions”. Determine if your product mix justifies such an investment or whether having one single strong product to take to market means this channel aligns into existing organisation design.

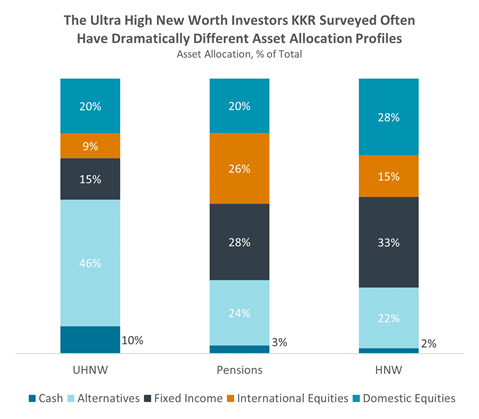

Define the Channel

Global Wealth refers to various channels where the end customer is an individual. However, that is where the similarity ends. Some investment firms may seek to focus on UHNW and Family Office client groups made up of professional investors for whom liquidity is less important than returns. Other firms may seek to build relationships with relevant investment platforms, broader private banks and even the mass affluent space. Where you want to be on this risk scale will determine how the product structuring, client service and sales & marketing strategy is built.

Fix the Plumbing First

The patience to reflect on what exactly needs to be done to be successful in this channel is critical to long term goals. A quick win is building a sales team on the ground and taking existing modified product to market. A better approach is effective engagement with client groups, understanding their challenges and aspirations and building this competence in house before the sales process begins. Client Service, Product Structuring, Channel Strategy are all functions that must be built alongside geographical coverage teams.

Internal Alignment

For managers with longstanding Institutional Coverage teams, the move into Wealth may appear straightforward. The challenges around regulation, liquidity profiles, product structuring, take time to get right. Equally, whilst Wealth fund allocation is increasingly “institutional” in its process, there remain differences in approach that require specialist sales experience that may not exist in-house. Appreciating this is a medium term opportunity (especially outside the US) and ensuring all internal stakeholders understand this will mean less pressure for quicker results and thus better long term prospects.

[1] https://www.privateequityinternational.com/private-wealth-the-road-lesstravelled/

[2] https://pws.blackstone.com/p/education-insights/blackstone-university/intro-toalternatives/#benefits-of-alternatives

[3-4] https://www.kkr.com/globalperspectives/publications/ultra-highnet-worth-investor-coming-age