21 March 2019

Anticipating widespread disruption from FinTech start-ups and new entrants, many financial services firms are already implementing innovation models to enable their long-term corporate growth.

Through talking to industry leaders, AMC has established the structure that firms need to adopt in order to embed a culture of innovation within their organisations and enable them to capitalise on the opportunities modern technologies provide.

Successful organisations of the future will be those that embed a culture of innovation within their firm as well as making strategic partnerships and investments with emerging fintechs.

This intelligence piece will set out the following:

1. The challenges and opportunities asset managers must navigate to ensure they are continually evolving and meeting the needs of their clients.

2. The ideal innovation framework that firms need to implement to evolve their organisations and enable them to remain competitive in the current and future tech-driven industry.

Challenges:

- In order to cut costs and improve the quality and transparency of services in an environment of rapid technological development, firms need to be more agile and quicker to react to emerging technologies. ‘Innovation’ is the way to get there.

- New entrants into the investment space do not have the burden of high cost infrastructure, employee numbers or regulatory costs. This combined with industry-wide margin pressures to provide customers with low cost investment funds is adding to the challenges asset management companies are facing.

- Asset managers can no longer act as observers to the changes in the industry. Instead firms need to recognise that innovation is now a key strategic imperative. Technology offers firms a means of overcoming such obstacles.

Roots of Disruption:

A recent report by McKinsey & Company ‘Synergy and disruption: Ten trends shaping fintech’ identified 4 particular sources of disruption facing financial services companies[1]

1. Infrastructure/service providers: Market entrants that present institutions with technologies that will enable them to digitise their current systems, improving their risk management and customer experiences.

2. Fintech start-ups: New companies, directly competing with legacy institutions to produce new financial products and services to consumers.

3. Legacy institutions: Companies investing significantly in technology to improve performance, respond to competitive threats, and capture investment and partnership opportunities.

Some financial institutions have begun engaging innovation models and strategies to ensure they are making best use of modern technology to offer competitive products, services and processes to their consumers. Others, however, have been slower to react and face a declining presence in the market should they fail to appreciate the business priority innovation presents.

How disruptors can complement the development of Asset Management Companies:

1. Capital Expenditure/Cost Management

The significant pricing pressure facing investment managers requires finding new ways to reduce fees for customers, whilst also maintaining margins through the lowering of operational costs.

- Challenge: FinTech companies (who do not invest in building an infrastructure and therefore do not have an infrastructure to maintain and develop) can better focus on core, strategic endeavours related to best serving customers.

- Opportunity: Digitising current systems and improving the efficiency of internal processes can be enhanced by partnerships with new infrastructure providers or by internal infrastructure developments to enable lower operation costs and a focus on value-added services for consumers.

- Ongoing challenges: Increased regulation will provide ongoing challenges for legacy firms who are not prepared for the costly data challenge that new compliance regimes require.

2. Investments and Propositions

The level and quality of data available to financial services institutions is a resource from which to generate new revenue streams through targeted product development, as well as applying consumer data to offer personalised investment recommendations.

- Challenge: The high-tech inception of new market-entrants enables a swifter harnessing of consumer data compared to legacy systems that are [more clunky/less possible] to derive data-driven insights and predictive analysis from.

- Opportunity: Big data can expose inefficiencies and create new value-add services surrounding market trends, whilst Artificial Intelligence (AI) can serve as an additional tool to exploit data for investment opportunities.

- Ongoing challenges: The marketing and development of managers as credible and responsible in their risk management remains essential to maintaining key client relationships, as AI and big data is an additional tool to asset managers rather than a replacement of management teams.

3. Customer Experience

The prevalence of smart phones and voice-activated virtual assistants across generations, offer an increasing number of platforms from which financial institutions can interact with their consumers aside from traditional face-to-face, telephone or online means. Asset managers need to renew the value propositions they present to clients.

- Challenge: Fintechs who offer modern branding with unparalleled levels of convenience through user-friendly apps attract the younger, tech-savvy, generation of future consumers.

- Opportunity: Legacy institutions have the capacity and consumer insight to develop customer experience platforms to retain and attract consumers. Opportunities lie in anticipating the customer needs of the future and having the technology, ecosystem and products in place to provide these services as customer appetite for it develops.

- Ongoing challenges: Traditional financial services firms must calibrate their customer experience initiatives to appeal to the diverse demographic of their consumers.

4. Cybersecurity:

Due to the reasons outlined in point 2 above, consumer data is significantly increasing in value and with this the need to protect data from cyber-attacks.

- Challenge: The roll out of two-factor authentication within retail banks and fintech companies has reduced some online fraud risks. Such systems however have also created new opportunities for attackers and the rapid change in the digital space makes the maintenance of effective cyber-security systems difficult.

- Opportunity: The increasing number of cybersecurity start-ups offer an opportunity for asset managers to partner with emerging organisations with the technical ability to provide their cybersecurity initiatives. Developing a robust cybersecurity program that includes updates to a firm’s consumers reflects the increasing importance with which consumers regard the safety of their information.

- Ongoing challenges: An expanding regulatory framework surrounding data handling will present a consistent and costly challenge for asset managers. In particular global managers servicing customers across a number of jurisdictions.

The Ideal Innovation Framework

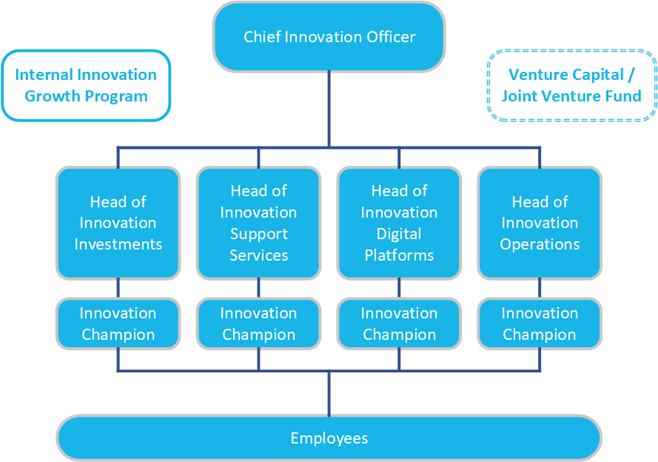

Asset managers can learn a number of lessons from other financial services organisations. For example, most retail banks have already employed innovation teams to focus on generating, developing and scaling initiatives from both internal and external stakeholders. The most successful are those that combine internal thought programs with a venture investing arm and work beyond a 1–3 year roadmap.

When asked what the key qualities of a successful innovation leader are, the Chief Innovation Officer at a leading retail bank told AMC that ‘project and relationship management is as important (if not more) than having new ideas.’ This is due to the fact that building a successful innovation ecosystem requires fostering an environment in which new ideas are consistently generated, tested and validated against the firm’s corporate strategy. It is therefore paramount that a firm’s innovation leaders are able to co–ordinate a network of initiatives.

To be successful, an innovation agenda must have the full support of a firm’s executive leadership. A successful innovation model, however, must also include the following components:

A clear view of what innovation means for the individual organisation and key areas of focus to align innovation with the firm’s corporate strategy, including:

- Progressing the firm’s current processes, products and customer services (0–3 year focus); and

- Equipping the firm with the product roadmaps and customer delivery capabilities that will be enabled by the technologies and consumer needs of the future (5/10+ year focus).

- A centralised function that has strong links into the business sectors through innovation leaders in each area.

- Support from a dedicated internal heavy–duty communications team to enable a flow of ideas.

- Innovation must be supported by a wide number of specialists to manage the advancement of ideas from concept to product.

- Innovation must be driven from the executive leadership of the organisation.

- Incentivising employees to become involved in innovation.

- A high degree of risk tolerance and desire to try a broad set of projects in the knowledge that only a small number will complete.

Ideal profile for a Head of Innovation

- A leader able to define and implement a focused and strategic innovation strategy that compliments the wider corporate aims of the organisation.

- 10+ years relevant experience leading: corporate innovation; strategy and/or new business creation.

Broad network of contacts across: FinTech; other financial services; other consumer industries and other academics. - A high level of commercial awareness that allows the identification of new market spaces, and analysis of trends and market disruptions to search for emerging market opportunities, including partnerships with others in the internal and external ecosystem to generate greater value.

- Supporting business units in new product and service initiatives – acting as methodology expert and facilitator for the most critical innovation teams across the company and supporting them in ‘raising the bar’ of their aspirations.

- Owning and allocating a dedicated budget to fund both ‘adjacent’ or ‘divergent’ ideas that are either too risky for the business units, or outside their existing business boundaries, which might not otherwise get funded.

- Project and relationship manager able to co-ordinate a network of programs that generate ideas internally and lead to their execution and implementation.

- An understanding of the organisation so to facilitate the co-ordination of effective talent coaching programs and processes that enable corporate entrepreneurship, and growth operation systems to embed a culture of innovation within the firm.

- Strong track record of project management and execution to enable the efficient and successful running of the innovation ecosystem.

- Ability to leverage experience and stature to work with senior management to drive the innovation agenda.

- Team ethic, a people person that is capable of building relationships and who is seeking to build success for the organisation first and their personal profile second.

Summary

In the face of greater competition from large technology companies and fintech start-ups, asset managers need to proactively participate in the development of financial technologies through acquisitions, partnerships or the evolvement of their existing capabilities.

As outlined in this document, the challenges facing asset managers brought on by increasing activities from fintech companies can be overcome. However, while a firm’s recognition that innovation is a key part of ensuring the longevity of their business is necessary, its ability to compete for present and future customers will be grounded in their ability to implement and maintain a focused and effective innovation ecosystem.

Innovation allows the flow of new ideas and concepts to ensure firms are prepared for the opportunities and challenges presented by technology. A failure to innovate runs the risk of firms becoming irrelevant to their customers, and thus less capable of growth.

Entry into the digital world is now more than ever an essential and integral part of a successful corporate strategy.

[1] ‘McKinsey & Company, Global Banking Practice ‘Synergy and disruption: Ten trends shaping fintech’ (2018).

AMC would be delighted to discuss this space in more detail. If so, please contact Navin Raina.