6 July 2023

Mark Carney released a book last year that Christine Lagarde succinctly summarised as being a text that ‘asks how we can go from knowing the price of everything to understanding its true value.’ Entitled Values, An Economist's Guide to Everything That Matters, Carney explores the relationship (and tension), between market-determined value and human-led social values.

Ultimately, he suggests that if nations continue to adopt a more values-based approach towards investment and the setting of economic goals, it will be possible to build a more inclusive, resilient, and sustainable future. Whilst the markets are not everything, Carney puts forth, they certainly play a critical role in solving many of the world’s greatest challenges. And to make the markets work, Carney sees mission-oriented capitalism as playing a vital role.1

This is where impact investing comes in.

The Global Impact Investing Network (GIIN) defines impact investments as those that are made with the intention to generate positive, measurable social and environmental impact, alongside a financial return. Similar to, but not synonymous with ESG investing, impact investing refers specifically to the capital that is directed towards businesses that are determined to drive environmental or social change. In her article for the Stanford Social Innovation Review, ‘ESG is not Impact Investing and Impact Investing is not ESG’, Jaclyn Foroughi explains that whilst ESG can be seen more as guidelines for an understanding of environmental, social, and governance factors, the for-profit nature of impact serves as a motivation to act in favour of and to drive funds towards these interests.2 These interests are valuable indeed. Looking towards some of the world’s most pressing challenges, the impact investment market seeks to provide capital to sectors that include sustainable agriculture, renewable energy, conservation, microfinance, and affordable as well as accessible basic services including housing, healthcare, and education.

What positive progress has been made so far?

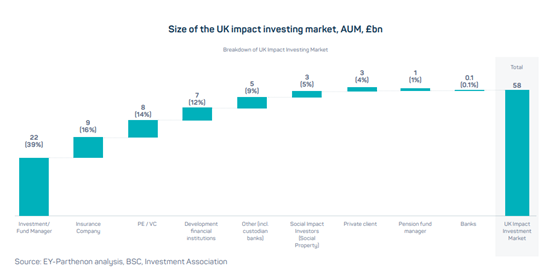

Impact investing in Europe has experienced significant growth in recent years. The market size has expanded, driven by increased investor interest, greater awareness of sustainability issues, and favourable regulatory developments, including the EU’s Sustainable Finance Disclosure Regulation (SFDR) and UK’s upcoming version, the Sustainability Disclosure Requirements (SDR). The European impact investing market has seen a steady rise in assets under management, indicating a growing commitment to socially and environmentally responsible investment. In a report released in 2022, following seven months of research, modelling and consultations, EY announced that the UK impact investing market had an estimated £58bn in AUM, with an additional £53bn of impact-aligned investments.3 With health care, affordable and clean energy, and sustainable cities and communities topping the list as highest receivers of investment, a full 90% of the organisations surveyed indicated that they plan to increase their asset allocation to impact investments in the next five years. This growth in engagement signifies a positive progression towards mainstream acceptance and integration of impact investing principles in the UK, alongside a wealth of countries across Europe, Latin America, Asia-Pacific and beyond.4

5

5

This growth has been aided by a diversification of impact investment vehicles in Europe, which provide investors with an increasingly broad range of options to deploy their capital for positive impact. Traditionally, impact investing has been primarily associated with private equity funds, such as the Triodos Organic Growth Fund based in Netherlands and the European Ambienta fund, or venture capital, such as UK’s Balderton Capital whose portfolio include Citmapper, GoCardless, and Northzone, a VC with its headquarters in Stockholm that focuses on clean energy technologies and digital health platforms. However, recent years have also seen a proliferation of other innovative investment vehicles including green bonds, social impact bonds, sustainable infrastructure funds and ESG-themed exchange-traded funds (ETFs). This diversification of choice has allowed investors to choose investments that align with their specific impact goals and risk-return preferences, making impact investing more accessible and flexible.

What are the talent implications of this growth?

The burgeoning impact investment industry in Europe and the UK carries significant implications for hiring and recruitment. As highlighted by the collaborative report released by EY and the Impact Investing Institute last year, there is a pressing need to expand the number of experienced impact investing professionals in the sector. In a survey carried out by the London Impact Investing Network (LIIN), 90% of the impact investing practitioners approached agreed that a gap of impact skills, such as an understanding of international frameworks and impact measurement, is one of the greatest challenges faced by the industry at this time.

The four of the most important skills for impact practitioners were identified as:

• Impact measurement

• Impact due diligence

• Impact reporting

• Stewardship / Shareholder Engagement / Investee engagement

Interestingly, shareholder/stakeholder engagement skills were noted by impact practitioners as being of more importance than impact reporting skills. Other key areas of expertise, such impact-aligned regulations, and thematic investments, were also identified that link to current trends, such as the EU Taxonomy and SFDR.

The rise of the impact investing sector demands a workforce equipped with a unique blend of financial acumen and social consciousness. Hiring professionals must prioritise candidates with a strong grasp of sustainable finance, combined with a genuine commitment to addressing global challenges, whilst ensuring that diversity and inclusion are central to recruitment strategies. To foster innovation and effective-decision making in impact-driven organisations, a wide range of perspectives must be represented.

What is to come next?

The world is grappling with an intensifying climate crisis, the fall-out from Covid’s long-tail, Russia’s invasion of Ukraine, increasing inequality and ageing populations. Impact investing will be a critical factor in supporting a just transition, or the greening of the economy in a manner that is as fair and inclusive as possible. To continue supporting the development of impact investing and its reach, the UK government will play a vital role in shaping the impact investing landscape through policy initiatives and regulations, including the issuance of green bonds, tax incentives for impact investing and integration of ESG considerations into investment practices. Crucially, asset managers must also demonstrate their commitment to integrating sustainability into their investment strategies and direct their focus to strategically recruiting and selecting professionals who have the capacity to consider ESG factors, risk mitigation, and long-term value creation.

May this time mark just the beginning of a flourishing impact investing sector. As Carney suggests; ‘When social needs are tackled with a profitable business model, the answers to many of the deeply rooted problems we face become scalable and self-sustaining.’

provides.

[1] Mark Carney - Values, An Economist's Guide to Everything That Matters, William Collins, 2021.

[2] https://ssir.org/articles/entry/esg_is_not_impact_investing_and_impact_investing_is_not_esg

[3] https://www.ey.com/en_uk/financial-services/how-the-uk-impact-investing-sector-measures-up

[4] https://thesvx.medium.com/what-nation-would-win-the-impact-investing-world-cup-6f5ce94c496

[5] https://www.impactinvest.org.uk/wp-content/uploads/2023/04/Estimating-and-describing-the-UK-impact-investing-market.pdf