22 February 2018

Over the last 18 months, we have seen a dramatic increase in demand from UK based client for talent located in key financial centres in the Continent. In this short paper, we discuss the catalyst for such demand and challenges of hiring within the various jurisdictions of the region.

Catalysts for Change:

Brexit

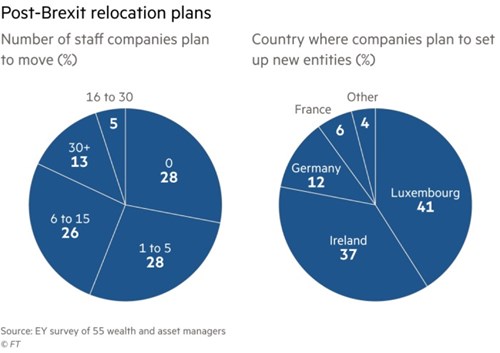

The most obvious reason for the increased demand for talent within EU countries is the need to respond to Brexit. With just over a year to go until the UK leaves the EU, the UK’s £8tn fund management industry has emerged as one of the most vulnerable sectors amid a lack of clarity over the transition. In a recent EY survey of 55 asset and wealth managers that oversee a combined €25tn of investments recently showed that half were working on or planning to expand their European operations in an attempt to insulate themselves from the effects of Brexit. This was up from 35 per cent of respondents in a similar survey carried out at the time of the UK’s referendum in 2016.

The majority of these hiring requirements reflect the regulatory requirements that our clients have deemed necessary to ensure continuity of business. This means bulking up existing operations or creating new ones. With Luxembourg and Dublin, the 2 clear choices for “Super Manco” type structures, the opportunity to locate governance roles in these jurisdictions is an obvious one. We have hired for several clients seeking Chief Risk Officers, Heads of Compliance and Chief Financial Officers into these 2 locations.

With individual clients who have pan regional leadership roles, there are also, of course, conversations about locating existing leaders within Distribution or Investments in some of these hubs. Generally, however, we are not seeing wholesale relocation of such roles, mainly a commitment to be visible in the office for a certain number of days a month as part of wider business travel requirements.

Whilst some of our clients are looking at what the minimum requirements might be to satisfy regulatory concerns, others are taking a more long-term approach to locating talent more broadly across the continent.

A recent visit to Dublin to meet a range of HR and business leaders in the industry suggested a real focus on building operational change capability within the office locales. Thoughtful, strategic talent acquisition strategies for the wider European and US based Irish diaspora who may be more amenable to a return home is now very much on the agenda.

Being able to identify, approach and engage such talent pools are taking on far greater importance as the UK’s hub status diminishes. We have recently completed a market research exercise for one client seeking operational leadership talent minded to be based in Dublin – either through family connections, or previous educational or professional ties to the city. Far from a straightforward exercise, but one that will yield value for a number of months to come.

A conversation with a US based behemoth suggested that where previously sales roles covering the EU might have been based in the London HQ to allow a “fly in fly out” approach whilst maintain a strong one location team, this is now no longer the case. Where headcount can be moved to local offices, it is. A recent search we undertook for a Nordic Salesperson covering Institutional clients is one such example. Where our client had historically located this headcount in London, it was now seeking to move that into the region. This has obvious benefits in terms of client appetite to engage with local teams, but Brexit provides another reason to make this happen.

An interesting aside from the EMEA HR Director of a Paris headquartered Asset Manager came in the form of a discussion about the attractiveness of London for their non-UK based employees. Whilst clearly the employment status of EU nationals currently in London is of concern – both a personal and professional one – she commented that there remains a continued interest from non London based EU nationals to relocate to London should the opportunity arise.

More generally, the potential impact of Brexit means clients are far more open to considering talent currently based in the continent for what were previously assumed to be London based roles. The hiring of individual contributors in sales roles who may or may not need to be located in an office rather than at home, is now a far more appealing option than it once might have been. This inevitably leads to other challenges - building one culture and a closely-knit team in a context where team members are more widely distributed is as greater challenge. However, this management issue is outweighed by the need to access talent wherever it might be.

Client Demand and Fund Flows

UK based asset managers seeking to expand their European based assets under management are actively adding talent to local markets. With regards to wholesale fund distribution, this is often a consequence of asset growth topping out in the UK – and the need to increase assets under management given increased costs of doing business means placing sales professionals locally makes sense.

The European Investment industry saw significant growth in 2017 – net sales of UCITS and AF reached 937bn, an increase of almost 500bn from the year before.

Fund selector relationships built locally are viewed as better options in the longer term and a number of our clients are actively building capability in key financial centres in Northern Europe. In particular, Germany, Benelux and Switzerland are seen as a key growth markets in the channel. Italy and Iberia have seen growth over the last few years also.

The pan European Insurance sector is also attracting increased interest from asset managers. Access to these pools of stable capital are very appealing. European Insurers are actively seeking yield, so asset managers with relevant product sets often higher up the alpha curve are gaining rapid interest. In particular, demand for illiquid strategies – Private Credit, Infrastructure Equity & Debt, Real Estate and Private Equity – is high, so investment firms with these capabilities are well placed to grow assets.

Nordic based fund buyers coupled with Swiss and German based insurers are open to direct discussions from London based firms, but a natural evolution of such client attraction is to base technical sales professionals on the continent.

AMC has also worked extensively with non EU based investment managers seeking to tap into this market from a London base. The ability to add sales professionals on a fly in fly out basis from London or locally on the continent appeals greatly to firms that believe they have the product to sell. A number of such firms have worked with 3 party marketing firms for an initial period and are now seeking to add their own sales teams to cover key financial centres in Europe – again, Germany, Benelux and Nordics being of most interest.

Structural Change in Continental European Asset Management

Employment in the European Asset Management Industry (c/o EFAMA "Asset Management in Europe")

More than 4,000 asset management companies in Europe directly employ 100,000 people at end 2017. Taking into account related services along the asset management value chain, it is estimated that another 460,000 people are indirectly employed engaging in functions servicing the asset management industry, thus bringing total employment closer to 560,000.

Over the last few years the Continental European based asset management industry has been through seismic change. Bank owned asset managers have had to manage their parent company’s’ post GFC financial travails whilst maintaining their own business models for clients and employees. Benelux based investments firms such as Dexia Asset Management (now CANDRIAM) and ING IM (NN Investment Partners) have managed to create new ownership structures through IPO’s or being acquired.

The consequences of the shock to the European banking industry are still being felt. Deutsche Asset Management has announced an IPO process to create some autonomy for that business and allow it to flourish from the shadows of the bank’s travails. Italian bank UniCredit recently sold its asset manager, Pioneer, to French based Amundi.

These “new” organisations have since reflected long and hard on their business models and how they engage with clients – current and future - around the world. This has led to significant pan European hiring of leaders within Sales, Marketing, Product and Client Service. Creating more performance led sales management processes has become critically important. As has the building of value add marketing functions with strong central functions to ensure consistency of approach with flexibility of local delivery.

Equally, the opportunities to meet the needs of the future for clients - building ESG compliant product and developing a range of Illiquid Credit strategies for example – means investment leadership hiring has been constant.

The growth of the European Investment market has coincided with this change and as such positive headwinds abound.

Searches we’ve conducted across all these areas involve multi location searches targeting talent from the UK as well as Continental Europe for roles in Germany, Benelux, France, Switzerland and Nordic region.

Country Specific Commentary

Germany

Market Overview

- Germany is one of the top institutional markets globally, with very advanced pension schemes and estimated E2.8tn of AUM.

- Highly fragmented with large Institutional fund buyers spread very widely geographically.

- Significant expansion in the ‘Spezialzfonds’ market (pooled smaller Pension schemes) driving demand.

- Historically strong grip on the market held by German providers who benefitted from tied distribution. However significant recent shift towards foreign entrants and niche providers.

Fund Flows

- Significant market shift in terms of asset allocation. Traditionally a risk averse, Fixed Income favoured landscape fund buyers are having to allocate large amounts to both Equities and Alternatives (including EMD).

- Strong Institutional and Wholesale demand for Multi Asset, outcome orientated solutions.

- Niche providers with different regional manufacturing hubs (Asia, South America etc.) are beginning to gain market share through concentrated actively managed equity and credit strategies.

Talent Markets

- Domestic Asset Managers benefit from a significant established presence meaning many of the ‘salespeople’ are much more relationship and client service orientated than is usual.

- Growing need for high content, product literate and motivated salespeople able to engage with clients in a solutions focused and consultative manner.

- Noticeable uptick in strong sell side talent migrating into Institutional sales roles bringing high energy, work rate and technical skills to bear.

Benelux

Market Overview

- NL is one of the top institutional markets globally, with very advanced pension schemes and estimated $1.5tn of AUM.

- A mix of DC and DB, but moving towards greater proportion of DC.

- Heavily regulated market, regulator is trying to promote market consolidation from current 300 Institutional funds to 50-60 (historically there were over 1000).

- Strong trend towards Fiduciary outsourcing for large Pension Schemes, Corporates etc with local providers such as Kempen, APG and Achmea dominating.

Fund Flows

- Alternatives, Real Assets and Private Equity are gaining increasing momentum and consumer demand as the hunt for yield continues. Typical asset allocation has shifted to c.50% bonds, 30% equities and 20% PE, commodities and Real Assets.

- Regulation states that the liability profile should be based on today’s interest rate, which has left many funds vulnerable to a funding deficit.

- LDI very important, strong fiduciary market – money managed by professional managers, with funds governance oversight

Talent Markets

- Focus on risk and governance functions due to heavy regulation

- High calibre distribution talent market. Fund buyers are very professional / analytical and expect similar levels of investment content and rigour from salespeople. Relatively strong trend towards hiring from Pension Funds and other Institutional funds into Sales role.

- Many foreign entrants have found fundraising up to £1/2bn relatively straightforward although a number have plateaued at that point.

Nordics

Market Overview

- Many are increasing their internal risk budget at the expense of the external; increasingly demanding clients.

- Alternatives and real assets / infrastructure still in strong demand: changing regulation of the AP-funds will create substantial demands for genuine yield providers.

- Consolidation in the largest AP funds, meaning less potential fund buyers.

- Still substantial variations persist between countries; Denmark is largely a credit / fixed income country; Sweden historically an equity culture; Finland and Norway far more ‘risk on’ and Alternatives focused.

Fund Flows

- Fixed Income funds, especially sub Investment Grade mandates are prevalent.

- Selective equity alpha (often value) products combined with increased passive product usage.

- Real assets and infrastructure a staple of the market demand at present particularly in Finland and Norway.

- Less issues exist in terms of funding deficits of schemes given many of the Fixed Income investments are not pegged to a historically low ROI.

Talent Markets

- Technically strong and complex fund buying community requiring highly investment literate and competent sales people.

- Blurring of Wholesale and Institutional clients means many business development teams do not split themselves in the traditional Institutional/Wholesale manner.

- Ability to speak with local based fund buyers and CIO’s of large schemes critical to ascertain where the top talent in the market sits.

Talent Implications

The scale of the UK’s investment industry means it remains a magnet for talent from around the world. Brexit, combined with changes in the Continental European markets is changing this paradigm.

A key concern for UK based Asset Managers going forwards will be their ability to hire the best talent available to them from whichever location. It is not uncommon these days for close to 30% of a UK Asset Manager’s employees to be non-UK citizens. Whilst we wait to see what the outcome of the HMG/EU negotiations are, this remains a concern.

Equally, the need to build scale on the continent coupled with the growth of the EU economy and its positive impact on EU domiciled Asset Managers means the need to hire on locally will grow more and more important.

AMC’s approach to this is to build local knowledge bases of talent pools within a specific function – be it in Distribution, Governance or Investment.

We layer on top of this a deep understanding of London based European talent who may, due to ongoing uncertainty, be more open to returning to their home countries.

The free movement of people across the EU also means we blend our talent maps to accommodate multi-jurisdictional talent to ensure full market coverage. For example, our hiring in Luxembourg encompasses talent from France, Benelux and Germany.

And finally, we ensure we have 360-degree views on talent – we make no assumptions about competence based on role title or longevity, but instead seek reference points from internal and external stakeholders. For example, when hiring for sales professionals, we will always speak to key fund buyers for their perspectives on who they rate – and work from there to identify top talent.

Clients seeking talent in Europe, therefore, need to ensure they partner with recruiters able to access talent in a thoughtful and strategic manner – not relying solely on existing sources of talent in local markets, but able to bring fresh thinking to increasingly limited talent pools. As a specialist Asset Management search boutique, AMC is incredibly well placed to partner with clients in such mandates, as our recent hiring track record reflects. Example AMC hires since 2017 include:

Governance:

EMEA Head of Compliance – Dublin

Chief Risk Officer – Dublin

Head of Finance – Luxembourg

Head of “Super Manco” – Dublin

Sales & Marketing:

Nordic Sales Director(s) – Copenhagen, Stockholm

Institutional Sales Director – Frankfurt

Head of 3rd Party Distribution – Cologne

Global Head(s) of Marketing – Paris, Brussels, The Hague

Wholesale Sales Director – Munich

Investment:

Head of Private Credit – The Hague

Investment Director, ESG – Brussels

Senior Portfolio Manager, Insurance - Frankfurt

Conclusion

Specialist leadership search firms such as AMC often see hiring themes reflecting changes in the industries they serve.

Whilst most of the work we do remains UK based, we’ve seen a steady and consistent rise in CE based hiring needs for UK based clients as well as domestic ones. As noted above, there are several reasons for this change but we’re confident it is one that will ultimately become the norm.

The ability to access local talent is critical in our success in such searches. With a depth of knowledge about local variations in talent markets, a rigorous research process and a total commitment to complete every mandate we work on, our clients are increasingly interested in our experience.