17 June 2019

As has been widely reported, 2018 was a record year for Infrastructure fundraising. In 2019, there are few signs investor interest in the asset class is wavering as firms continue to announce record busting fund closes.

In this article, we highlight the key themes influencing capital allocation that investors, fundraisers and those working with infrastructure funds at present. These can be summarised as follows:

- Concentration of capital to larger funds.

- Increasing preference for sector specific funds.

- Diversity Challenges in the industry.

- Importance of ESG in LP Allocation.

- Investor concerns regarding achievement of target returns.

- Growth of asset class requiring strong IR capabilities alongside capital raising efforts.

Increased concentration of capital to larger funds

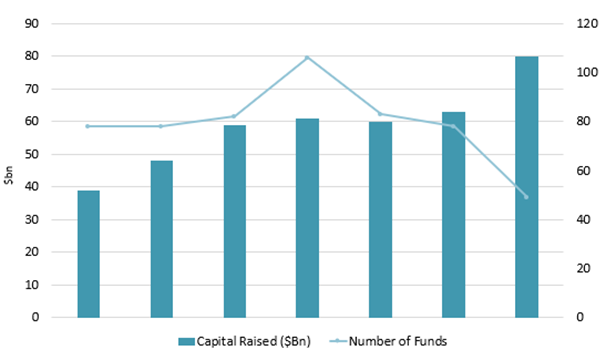

The graph above shows that whilst the amount of capital flowing into European infrastructure funds has increased in recent years, the number of funds in which this has been allocated to has decreased.[1] This is unsurprising considering the larger funds pushing hard cap targets to record levels. Nevertheless, large influxes of capital have also been seen by smaller boutique firms with space in the market for a blend of firms to succeed.

Increasing preference for sector specific funds

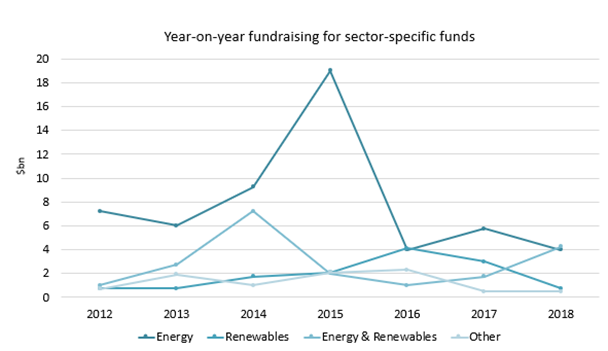

Although infrastructure is characterised as a single asset class, the range of industries and products it encompasses is significant. Infrastructure Investor reported that 1 in 3 of infrastructure funds closed in 2018 were generalist mandates, showing a high degree of appetite for both generalist and sector specific funds.

As can be seen from the graph below, Energy and Renewables funds had the largest increase in investor commitment from 2017-2018, collecting $5.25bn across six funds in 2018. It is likely that this area will see continued growth in the coming years in light of a growing number of countries committing to decarbonisation. Also, utilities being exempt from the same forces effecting public markets are likely to see an increase should markets enter a downturn. Worthy of note is also the impact of technology that is creating opportunities for all sectors in particular transport, fibre broadband and energy. [2]

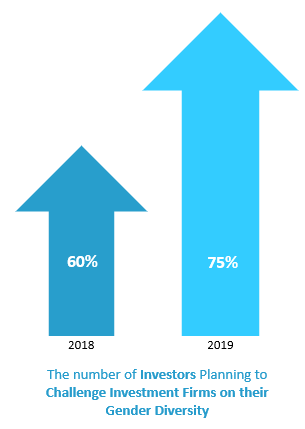

Increasing number of Investors challenging managers on the diversity within their organisations

According to KPMG’s Women in Alternative Investments report, 75% of investors surveyed plan to challenge investment firms on their gender diversity this year – rising from 60% the previous year.[3] Recent reports have also shown that investors are not just making inquiries about diversity but considering it with such weight that it impacts capital allocation. For example, the Chicago Teacher’s Pension Fund turned down a $50 Million commitment to The Blackstone Group and Brookfield Asset Management recently and cited a lack of diversity as one of the key reasons for this decision.[4]

Growing Importance of ESG in LP Allocations

Interest in ESG has increased across all asset classes, including infrastructure investing. LPs are increasingly requesting ESG disclosure in due diligence processes and GPs will need to increase the amount of ESG-related commentary in quarterly reporting. LPs report to be particularly concerned with the following:

- A manager’s ongoing process for identifying and acting on ESG-related opportunities and risks.

- A manager’s process in relation to new or ongoing litigation issues pertaining to ESG.

- A manager’s communication of material ESG issues that may impact the value of the portfolio, including such items as assessing climate change risk.[5]

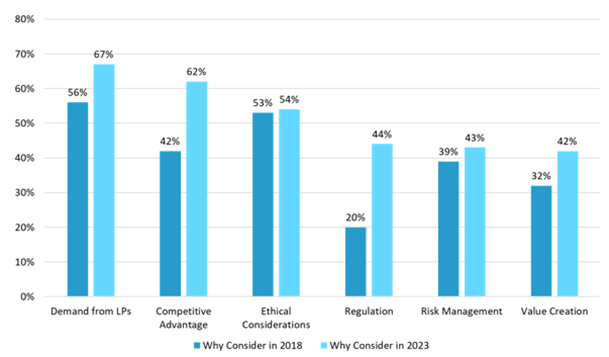

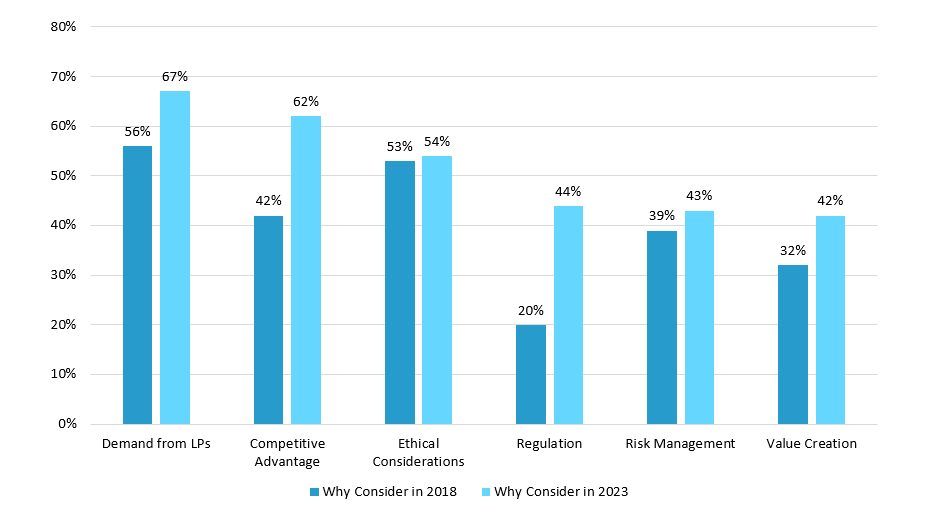

Motivations for considering ESG vary between managers, the most common being demand from LPs, ethical considerations and competitor advantage. The graph below also indicates that over the next 5 years the number of managers motivated by regulation to consider ESG related issues is predicted to double.[6]

Investor concerns regarding achievement of target returns

There are a number of reports detailing investor concerns surrounding market forces that will impact fund performance in 2019/2020. The most common (66.3%) being that high market valuations will affect manager ability to meet target returns as increased competition for assets inflates prices. However, the definition of infrastructure investments will need to expand and opportunities to enter secondary markets utilised.

An increasing number of investors (56.1%) also consider rising interest rates to be a threat to target returns, if not to the same extent as other asset classes. Weakening of economic growth in the event that the US and China enter a trade war is also a concern for 33.7% of investors.

However, infrastructure could also benefit in this event having shown ability to outperform other classes when the broader economy is weak.[7]

Growth of asset class requiring strong IR capabilities alongside capital raising efforts

As infrastructure managers become increasingly established, the ability for Senior Investment Professionals to also be the primary contact for ongoing client requests and concerns is becoming increasingly inefficient. Alongside building strong capital raising networks therefore, either through the use of in-house teams or placement agents, firms need to build investor relations capabilities that can continue to drive strong relationships with investors whilst enabling senior investment professionals to be focused on deal origination and execution.

Summary

In a competitive market, firms can distinguish themselves by providing investors with niche strategies focused on specific geographies or sectors; or by establishing a portfolio that provides investors with exposure to different risk profiles that the firm can align with the specific needs of investors. However, to remain competitive, broader issues surrounding ESG and Diversity need to be a key element of corporate strategy.

________________________________________________________

References:

[1] Infrastructure Investor, Fundraising Report, April 2019

[2] Infrastructure Investor, Fundraising Report, April 2019

[3] KPMG, The call to act: Women in alternative investments, February 2019

[4] Infrastructure Investor, Diversity a factor in Chicago Teachers’ decision to pass on Blackstone and Brookfield, June 2018

[5] Preqin, CalPERS: ESG and Private Equity, May 2019

[6] Preqin, The Future of Alternatives, May 2019

[7] Preqin, Key Findings: 2019 Preqin Global Alternative Assets Reports, April 2019